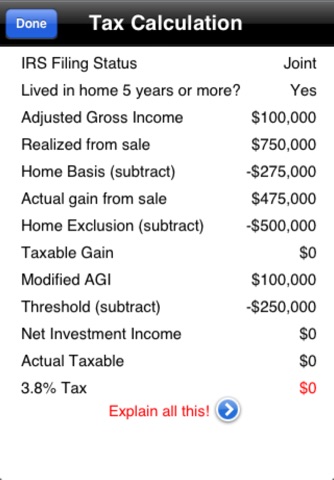

Will you have to pay a special investment tax to support ObamaCare when you sell your home? (probably not . . . )

The Health Care and Education Reconciliation Act imposes a tax equal to 3.8 percent of the lesser of

(A) net investment income for such taxable year, or

(B) the excess (if any) of the modified adjusted gross income for such taxable year, over the threshold amount . . .

What does all that mean? Despite all the dire predictions, it doesnt mean that youre necessarily going to pay this tax when you sell your home. It depends on your adjusted gross income, your IRS filing status, whether or not youve lived in that home as a primary residence at least 5 years, and the profit, if any, that you make when you sell that home. Its pretty complicated, but this app performs the calculations for you and estimates your bottom line.

The first version of this app only addressed the home sale tax. This new version includes calculators for the Net Investment Tax and the Additional Medicare Tax, plus information on Obamacare features, tax considerations, and State Insurance Exchanges.

As we said, the taxes calculated in this app are just estimates. You should consult your tax attorney for the real numbers. And D & N Associates, Ltd. cannot be held liable for any problems with your taxes.